Who Generates Trade Carbon Credits?

Generates Trade Carbon Credits

Carbon credits are certificates issued by national or international governmental organizations that allow companies to avoid releasing greenhouse gases. These credits can be traded for cash, and can contribute to environmental, social, and economic benefits. Several industries are incorporating these products into their business operations.

The price of trade carbon credits is dependent on the nature of the underlying project. If it is a community-based project, then the price will be higher than if it is an industrial project. This is because the community-based projects are typically managed by local groups, and they often generate more co-benefits than industrial projects.

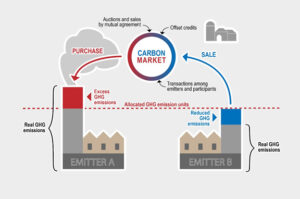

The carbon credit market is divided into the upstream and downstream markets. The upstream market is made up of end buyers and traders. These buyers use the credits to meet a corporate sustainability target. These are mainly private individuals, companies, and other non-profit or for-profit organizations. The downstream market consists of a number of brokers and financiers, who are interested in the financial benefits of green business practices.

Who Generates Trade Carbon Credits?

Carbon credits are distributed in proportion to the amount of CO2 emissions produced in the previous year. They represent a metric ton of reduced CO2 and can be used by both companies and individual consumers. Typically, the price is quoted in Euros per tonne of CO2e. The value of these credits varies greatly, ranging from just a few cents for afforestation projects to $15/mtCO2e for tech-based removal projects like CCS.

During the 2008 global economic crisis, the voluntary carbon markets suffered a setback. However, with the new wave of commitments to curb carbon, a resurgence in interest in these credits has occurred. Some of the early buyers include oil and gas majors, airlines, and technology companies.

Carbon offsets are another form of carbon credits. They are a way for companies to work with environmentally conscious offset sellers. These projects can help to reduce pollution by using methane from swine farms to fuel a power station that would normally use fossil fuels. They also contribute to better water quality and contribute to a reduction in economic inequality.

Several international carbon markets have been established. They are operated on a “cap-and-trade” principle, in which polluters who are beyond the cap are required to purchase permits from others. These are then sold to countries that are exceeding their quota under the Kyoto Protocol. These transfers are validated by the UNFCCC.

Carbon credits are also issued in other types of markets. For example, California’s Carbon Market is designed to help lower greenhouse gas emissions from the state’s electricity and gas sectors. In addition, many industry sectors are looking for ways to hedge their financial risks as the energy transition continues. The Regional Greenhouse Gas Initiative, which was formed in Connecticut, Maine, Maryland, and Massachusetts, is one such market.

These credits are primarily used to reduce the global warming potential of CO2. The Kyoto Protocol established the first international carbon market, and several other international treaties have since followed. These treaties create markets for emissions permits and carbon credits, and require that countries monitor and verify their emissions.