How to Increase Your Credit Card Limit

Increase Your Credit Card Limit

The first step in learning how to increase your credit card limit is to call the issuer and request an increase. This process can either be immediate or take a few days. After the request has been submitted, you will be notified of the decision and given time to make alternative plans if needed. If you’ve used the same card responsibly for six months or longer, you’ll have a better chance of getting approved.

The next step is to call the credit card company and request an increase. You should mention that you’ve been a great customer and that you’ve recently received a raise in your salary. This will help your account’s credit score look more appealing to lenders. It will also save you money down the road when you can afford the higher interest rates. If you’re successful, you can expect a credit limit increase in less than six months.

Once you’ve called the issuer, wait six months and ask for a higher limit. Most issuers will automatically increase your credit limit. If you have a good history, you should be able to get a raise after six months. Be patient and responsible and you’ll get the raise you’ve requested. Remember that it’s not an easy process, but it’s worth trying. Follow these tips and you’ll be well on your way to a higher credit card limit.

How to Increase Your Credit Card Limit

After waiting six months, call the credit card company and request an increase. Explain your situation and ask for a higher limit. Include reasons for the increase, such as your recent raise or good payment history. This will make you more appealing to creditors. You can also get an additional credit line when you’re eligible. There are some common mistakes you should avoid when increasing your credit line. Once you’ve made the mistake of requesting a higher limit, you’ll regret it in the long run.

Increasing your credit limit can help your credit score. If you’re paying on time, you’ll have better credit, which means that your interest rates will be lower. Eventually, you’ll be able to get a higher credit limit. You may even be able to get a lower interest rate, which will make it easier for you to pay off your bills. If you want to increase your credit line, however, you can request a higher limit from your current lender.

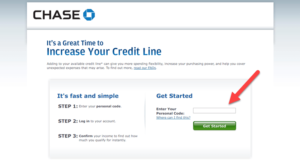

You can also ask your credit card issuer to increase your credit limit for you. Each company has its own process. It may be done online, via their mobile app, or by phone. Once you’ve asked for an increase, be prepared to answer questions that are specific to your situation. Some credit cards will not let you raise your limit, so be realistic in your request. This will benefit both you and your creditor.